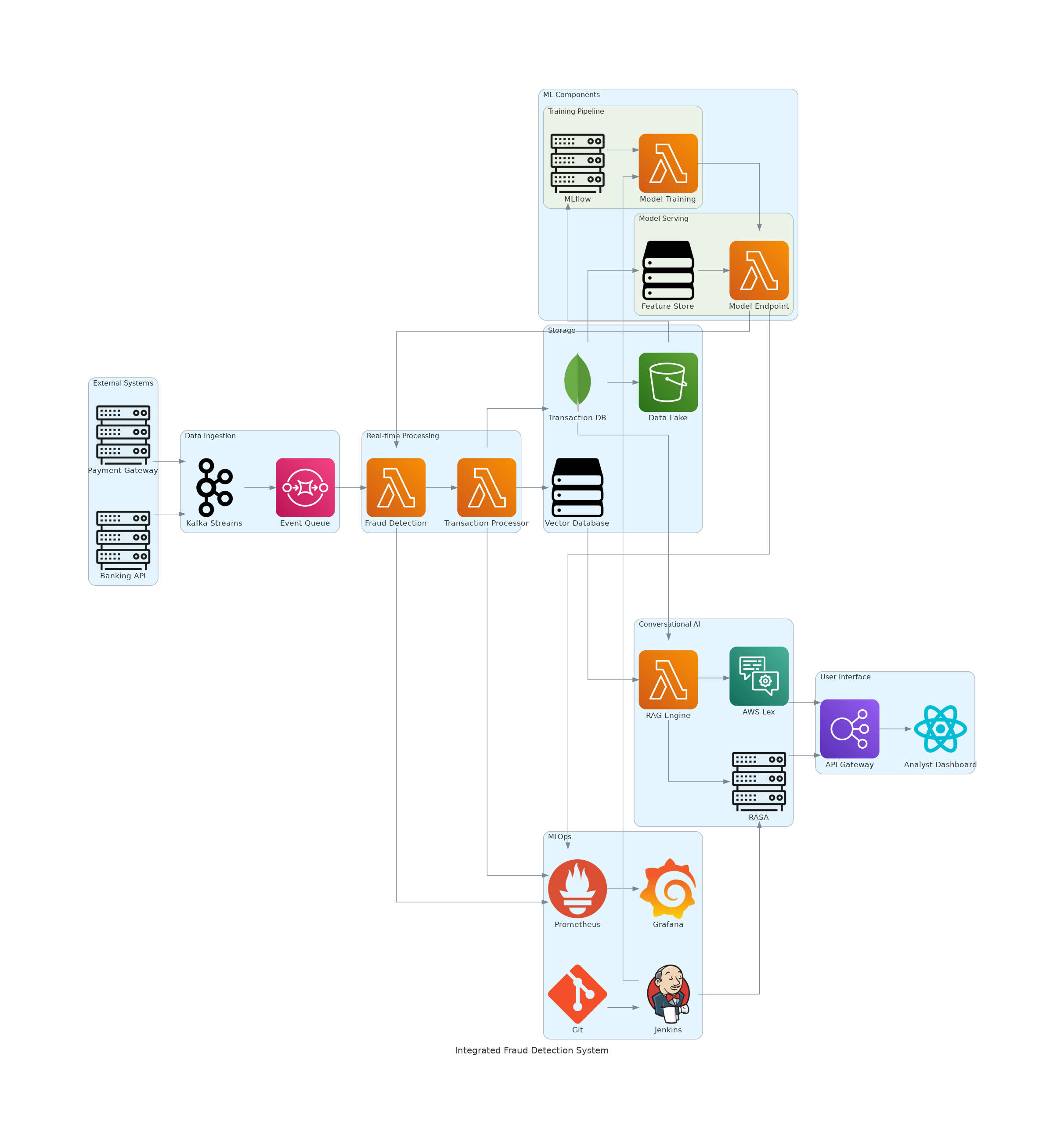

Architecture

Architecture Components

- Data Ingestion: Kafka streams for real-time transaction data

- Real-time Processing: Lambda functions for fraud detection

- Storage: Transaction DB, Vector Database, and Data Lake

- ML Components: Training pipeline and model serving

- Conversational AI: RASA, AWS Lex, and RAG Engine

- MLOps: Jenkins, Git, Prometheus, and Grafana

- User Interface: API Gateway and Analyst Dashboard